GCash APK 5.92.4

Mod

Mod- Android 5.0 +

- Version: 5.92.4

- 154.06 Mb

Updated to version 5.92.4!

GCash APK: The Essential Guide to the Philippines’ Leading Digital Wallet

GCash APK is the standard Android application package for GCash, a financial super app designed to meet the needs of users in the Philippines and Filipinos across the globe. Developed by Mynt (Globe Fintech Innovations, Inc.), GCash stands at the forefront of the country’s fintech movement, offering a unified platform for digital payments, savings, investments, and more all from your mobile device.

What is GCash? Understanding the App and Its Developer

GCash is a comprehensive mobile payment app and digital wallet, purpose-built for individuals looking for an accessible, all-in-one solution to personal finance. Operated by Mynt and supported by Globe Telecom and Ant Group, it is regulated by the Bangko Sentral ng Pilipinas. The app’s primary function is to provide users with a secure digital wallet, serving as an alternative to cash and traditional banking.

GCash is categorized as a financial super app. It integrates money transfers, bill payments, savings, credit, insurance, and investment capabilities into a single interface. Available free for Android users, GCash is widely recognized as a trusted e-wallet in the Philippines, allowing users to manage their finances anytime, anywhere.

Exploring the Key Features of GCash

GCash offers a blend of practical and advanced features designed to make financial management seamless for everyday users.

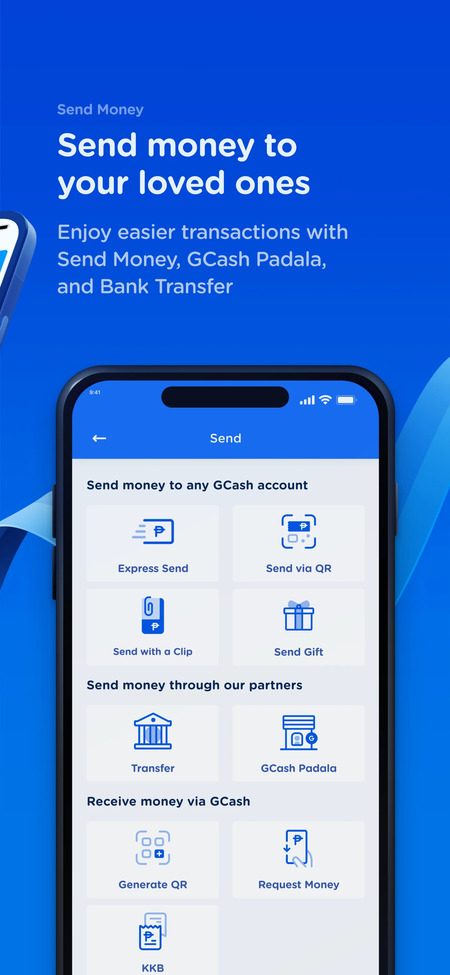

Send and Receive Money

With GCash, you can send money to other GCash accounts, banks, and partner wallets within the Philippines and beyond. Transfers are processed in real-time, providing a reliable tool for domestic transactions and supporting overseas Filipinos needing to remit money to families back home.

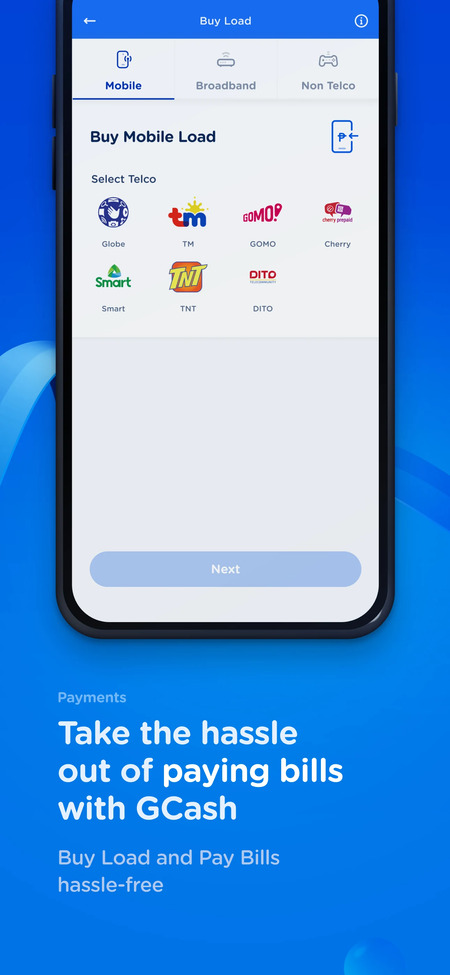

Bill Payments and Mobile Load

GCash enables you to pay bills directly from the app, covering utility companies, government services, educational institutions, and more. The platform also allows the purchase of mobile load for major telecommunications providers, making it easy to top up any prepaid number while keeping transaction records organized.

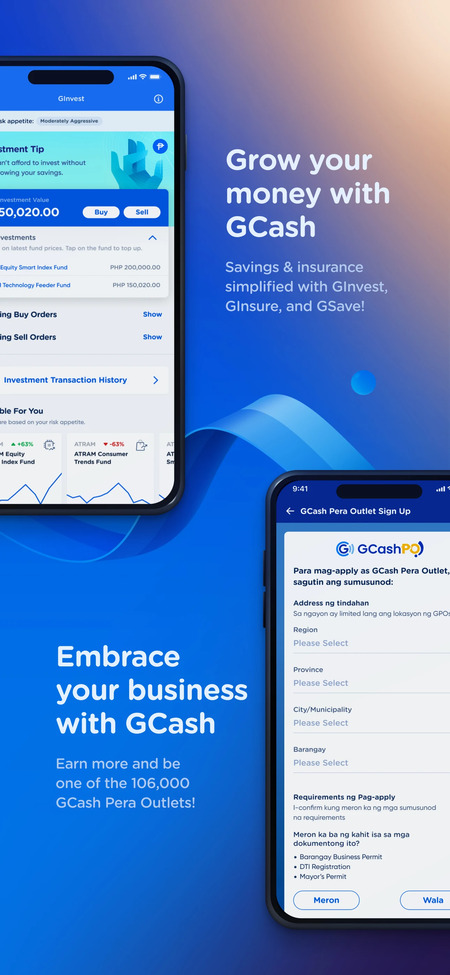

Savings, Investments, and Credit

The app includes features for saving money with GSave, which offers basic digital savings with no minimum balance. Users can venture into investing through GInvest, accessing funds, stocks, and select cryptocurrencies at affordable entry points. For those needing credit, GCash provides GCredit and GLoan, giving qualified users access to lines of credit, personal loans, and installment plans through straightforward application processes.

Additional Services

GCash promotes cashless payments via QR code scanning at partner merchants, both online and on the ground. The app also introduces micro-insurance products (GInsure) and avenues for supporting environmental programs and donations, broadening its role beyond basic financial services. Each feature is tailored to real-world scenarios, such as paying for groceries, securing insurance coverage, or contributing to community initiatives.

Using GCash: How to Get Started and Everyday Scenarios

Setup and Navigation

For new users, getting started involves creating a GCash profile within the app and completing an identity verification process. This step unlocks the full range of services, requiring a valid mobile number and some personal details. Once verified, users can easily navigate the home screen, where the main modules cash in, send money, pay bills, buy load are clearly displayed for intuitive access.

Common Use Cases

GCash fits many everyday situations. Users can pay utilities, tuition, or government fees without leaving home. Sending money to friends and family, splitting a bill, or purchasing mobile load for relatives has never been easier. For personal finance, the app helps manage savings, investments, and credit, all in one place. Filipino users abroad also use GCash for remittances and bill payments back home, reflecting its cross-border capabilities.

Understanding GCash Service Categories in Depth

Below is a table summarizing the main service categories and general capabilities found in GCash:

| Service Category | General Function | Everyday Use Case |

|---|---|---|

| Money Transfer | Send/receive funds locally & internationally | Remittance to family |

| Bill Payment | Pay utilities, government, education | Settle monthly bills |

| Mobile Load | Purchase prepaid phone credits | Top up own or others' numbers |

| Savings | Open and maintain digital savings account | Start a no-minimum deposit account |

| Investments | Invest in funds, stocks, crypto | Grow savings at user-set pace |

| Lending | Borrow via credit or loans | Access funds for urgent needs |

| Insurance | Enroll in microinsurance | Secure health or life coverage |

| QR Payments | Scan and pay at merchants | Cashless checkout in stores |

Money Transfers

Users can transfer funds to other GCash users, bank accounts, or select partner wallets within established daily and monthly limits. Group transfers and batch payments are also supported, catering to family or small business needs.

Bill Payments

GCash provides an extensive range of biller categories utilities, internet, government fees, schools, and more. The process is straightforward: select the biller, input the account details, and pay. Transactions are logged for easy tracking and future reference.

Mobile Load Purchase

Buying mobile load is quick and supports all major Philippine networks. Users choose the load type and amount, enter the recipient number, and complete the purchase with one tap.

Savings & Investments

Opening a savings account requires only a few taps, with no minimum deposit. Investments can begin with small amounts, letting users build a portfolio in domestic and select global funds, stocks, or digital assets from within the app.

Lending Solutions

Once eligible, users can apply for credit lines (GCredit) or one-time loans (GLoan) with the app’s built-in evaluation of account usage. Repayment schedules and limits are set according to app guidelines, making the process transparent.

Insurance Offers

GCash includes access to affordable insurance products. Options cover a range of needs, and users can enroll and manage policies digitally with simple steps.

GCash Fees and Requirements: What Users Need to Know

GCash applies straightforward fees to specific services. Most money transfers, bill payments, and mobile load purchases incur either fixed fees or a small percentage of the transaction amount. Cash-in via partner outlets or bills payment from a GCash wallet is often free, while transfers to banks, international remittances, and cash-out services may carry charges. Users should consult the in-app fee schedule to confirm current rates, since these may change.

To use GCash, basic requirements include a compatible Android device, a Philippine mobile number, and verified identity documents for full-feature access. GCash requires users to complete KYC (Know Your Customer) verification to unlock credit, lending, and investment functions.

GCash Across Borders: International Features and Availability

GCash extends its services to Filipinos abroad and supports select international users. The app can be used to receive remittances, pay bills remotely, and maintain connections to family needs in the Philippines. English language support is built in, and GCash continues to develop features for broader global use.

For users outside the Philippines, eligibility and supported features may vary; cross-border transactions work with recognized partners, accommodating the needs of overseas Filipino workers and global users seeking a reliable mobile finance tool.

Summary: Why GCash APK Sets the Standard for Mobile Financial Apps

GCash APK delivers a complete digital wallet and financial management platform tailored for Filipinos and the broader global community. By integrating payments, transfers, savings, credit, insurance, and investments, GCash stands out as a financial super app in the e-wallet Philippines landscape. Its evolving feature set and practical everyday applications continue to support its reputation as a go-to mobile finance solution for users seeking convenience, financial control, and cross-border accessibility.

FAQs about GCash

- UpdatedOctober 26, 2025

- Price$0

- Installs 59

- Rated for Everyone

You can quickly and easily Download the Latest Version of GCash from our TechBigs.Io Website